Accelerated LBO modeling. Dominate the next deal.

In pressure cooker environments, speed is everything. With ModelReef, full-scale LBO modeling is faster than ever. Project returns, cash flows, and leverage instantly, without touching a single formula. Our AI handles the heavy lifting.

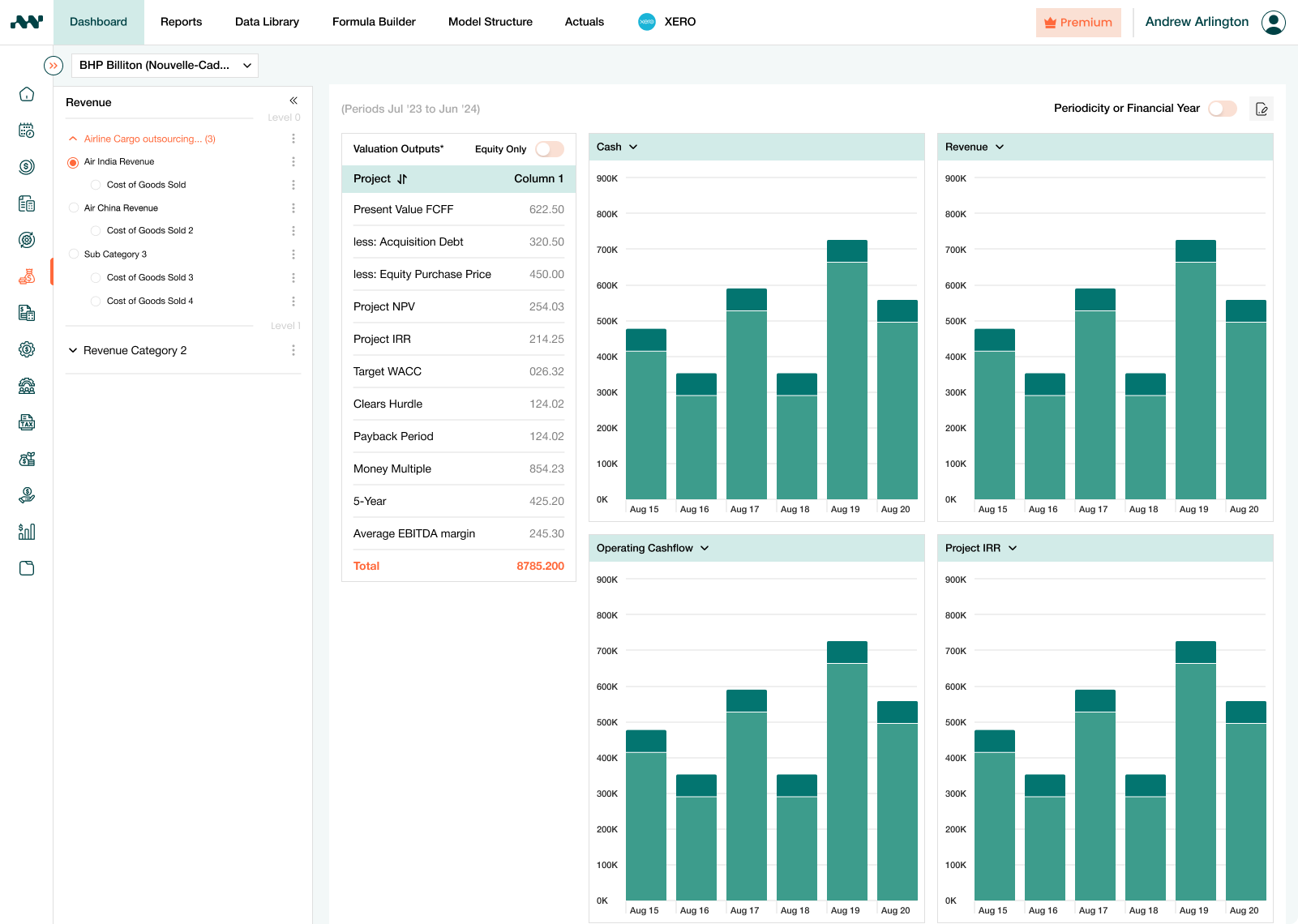

Try nowFrom data dump to deal-ready in seconds

LBO modeling doesn't need to start in a spreadsheet warzone. Simply drag and drop your historicals, and our AI generates a fully linked 3-statement model in seconds.

The forward projections? Already done. The balance sheet? Always balanced. Step in only to refine, not wrestle with broken formulas.

IRRs that don’t stall when you stress-test the deal

Recalculate IRR and Money Multiples instantly with no delays. Sensitivity testing becomes seamless, even as you shift key levers like EV/EBIDTA or leverage. The model flexes in real time, giving you clarity on the full return profile.

LBO modeling isn’t just about building scenarios. It’s about trusting them under pressure. ModelReef delivers return metrics that stay unbreakable, even when you push the deal to its limits.

LBO modeling without the debt schedule headaches

Reduce complex debt structures to just a few, intuitive clicks. Instead of spending hours manually tabling out each debt tranche, ModelReef does it instantly. Estimate debt capacity and anticipate cash shortfalls in real-time.

Build fully detailed debt stacks in seconds. Each tranche is structured with automated repayment tables, and interest calculations are automatic. No broken links. Zero rebuilds.

One Model. All Scenarios.Zero Rework.

LBO modeling in Excel often means building two versions of the same deal - leveraged vs unleveraged. ModelReef eliminates that redundancy. Run both capital structures side by side within a single, fully integrated LBO model.

Get instant, sponsor-focused IRR visibility under any stress test. Toggle assumptions, adjust leverage, and immediately see how debt impacts value creation.