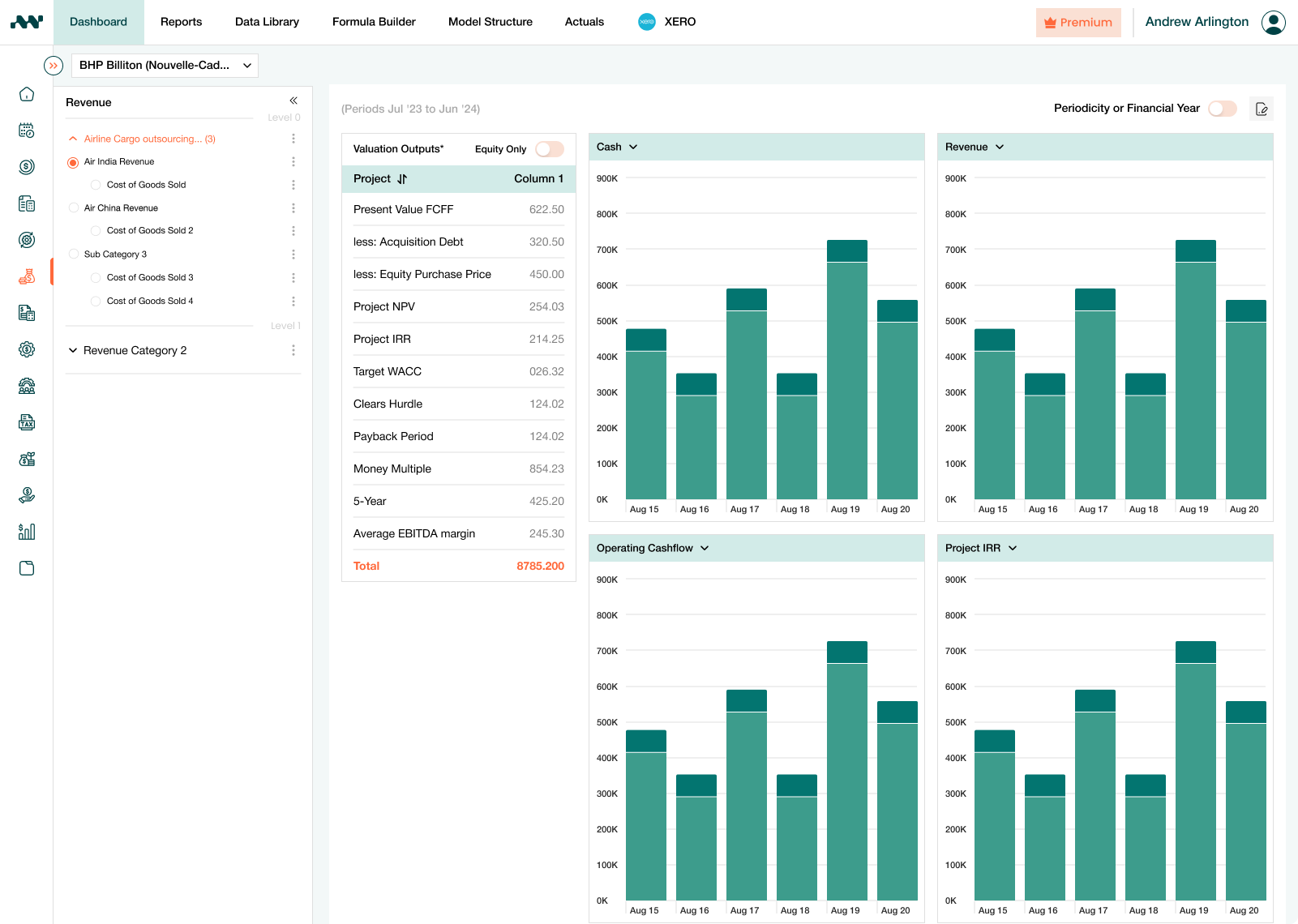

Track cash timing with precision

Connect receivables, payables and inventory cycles into one cash flow model. Predict exactly when cash will hit your account and plan around seasonal variations without manual tracking.

Plan working capital changes automatically

Update payment terms, inventory, or sales growth and see instant impact in your cash flow forecasting model. Understand how operational changes affect liquidity before making commitments.

Test funding scenarios before you need them

Model different growth rates, payment terms and seasonal patterns in your cash flow projection model. Present multiple funding scenarios to banks and investors with confidence.

Keep stakeholders confident in your numbers

Generate lender-ready cash flow models that satisfy bank covenants and investment committees. Translate assumptions into clear projections that build trust.