Get business valuations right, every time.

When deal timelines are moving fast, let our platform handle the modelling and cut valuation time from weeks to hours. Test scenarios, check enterprise value calculations and compare methods instantly, without complex formulas.

Try nowValue companies accurately under pressure

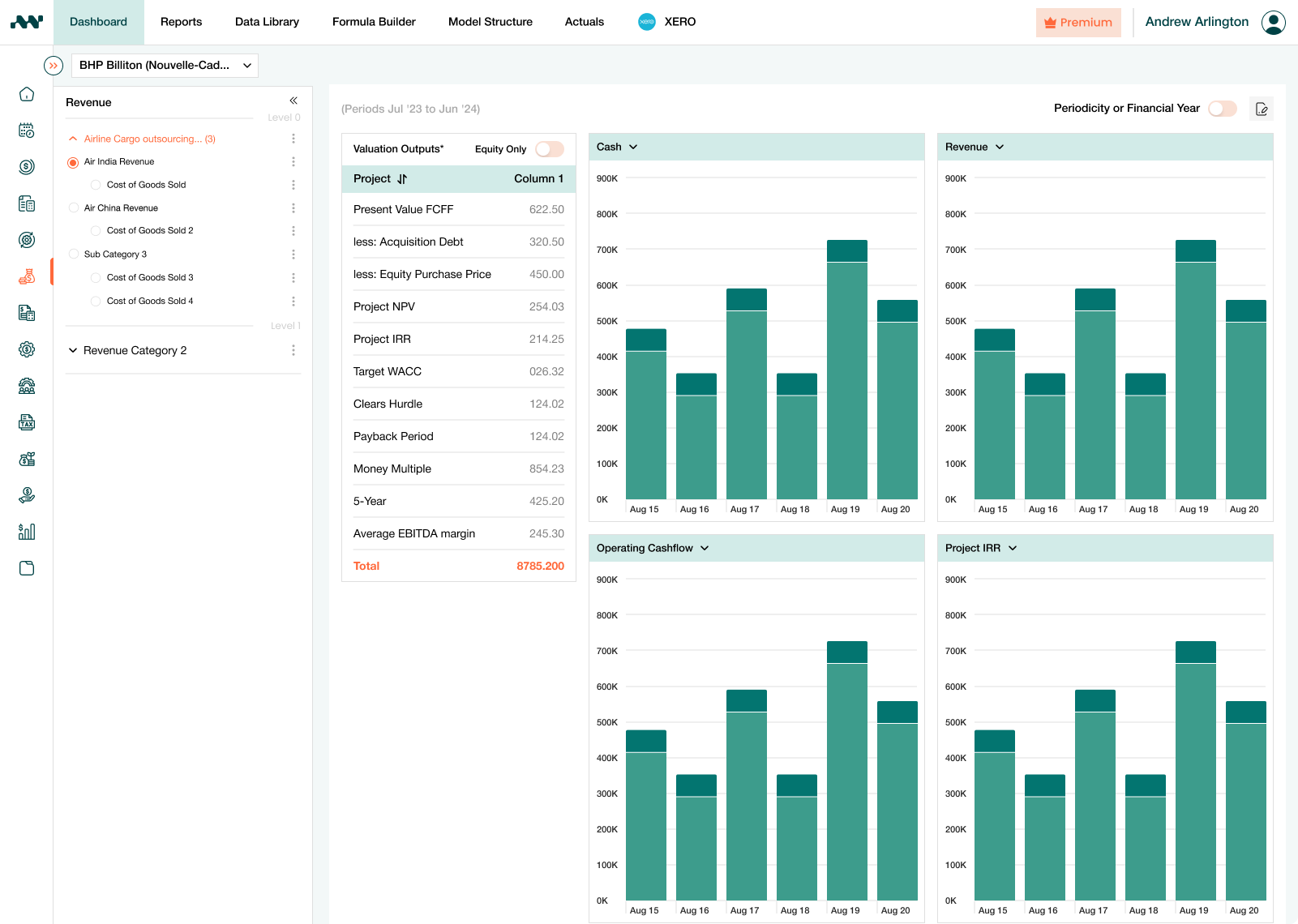

Connect market data, financial forecasts and valuation multiples into one reliable business valuation framework. Handle complex DCF models and comparable company analysis without formula errors or version conflicts.

Respond to market changes instantly

Update discount rates, growth assumptions or exit multiples in your company valuation calculator and see the impact flow through all valuation methods immediately. React to new information without starting from scratch.

Test deal scenarios before committing

Model different purchase prices, financing structures and market conditions side-by-side. Present multiple valuation ranges that give stakeholders confidence in deal parameters.

Close deals with credible analysis

Export professional reports from our business valuation tool that pass due diligence and investor scrutiny. Back every number with transparent methodology that investors and boards trust.