![What is a Normal Balance in Accounting? Step-by-Step Guide [+Free Template]](https://www.modelreef.io/wp-content/uploads/2025/04/Normal-Balance-in-Accounting-1.png)

What is a Normal Balance in Accounting? Step-by-Step Guide [+Free Template]

The basic principles of accounting are essential for any individual wanting to analyse financial data or conduct business finances successfully. One of these core principles is the idea of a normal balance, a simple and potent concept that forms the foundation of the entire double-entry bookkeeping system. Whether you’re a student new to the fundamental principles of… Continue reading What is a Normal Balance in Accounting? Step-by-Step Guide [+Free Template]

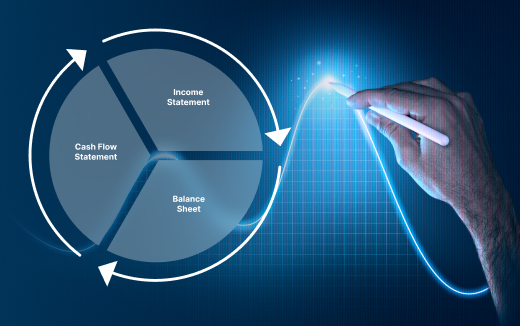

Three Financial Statements:The Ultimate Guide

In the booming stock market of the 1920s, investors were largely in the dark when choosing where to invest—companies weren’t legally required to share their financial information. This lack of transparency played a key role in the devastating market crash 1929. In response, the government introduced new laws to protect investors and bring accountability to… Continue reading Three Financial Statements:The Ultimate Guide

Efficient Cash Management: Download Your Free Cash Counting Worksheet

Cash is what any business stays alive with, irrespective of the size and niche. You can run a small retail store, a local restaurant, or provide a cab booking service or you can run a large enterprise, cash always comes at the centre of all your activities. When your business has enough cash flow, it… Continue reading Efficient Cash Management: Download Your Free Cash Counting Worksheet

What Is a Business Valuation, and How Do You Calculate It?

Suppose as a business many of your products earned a legendary reputation, you have a loyal customer, and your revenue grows steadily each year. But now you’re considering retirement or perhaps expanding into a franchise. Suppose you’re seeking investors to scale operations. A clear valuation shows potential backers how their money will grow. Suppose you… Continue reading What Is a Business Valuation, and How Do You Calculate It?

Financial Modeling Techniques: Selecting Operating and Financial Scenarios

Financial modeling is frequently described as a practiced science making viable assumptions and drawing relevant and actionable insights from them. To be more precise, financial modelling is used to represent the financial future of the company in a wadevy to help it adapt to different challenges and scenarios. But the real challenge lies not in… Continue reading Financial Modeling Techniques: Selecting Operating and Financial Scenarios

How The Power of One (1%) Cash Equation Can Transform Your Financial Strategy

Finance is a dynamic world where businesses all the time look for strategies to stay ahead of competition and boost profitability. Ensuring enough cash flow is part and parcel of this strategy. Among the many time-tested methods and approaches, the Power of One cash equation is known for being highly effective and easy to implement.… Continue reading How The Power of One (1%) Cash Equation Can Transform Your Financial Strategy

DCF Valuation Formula & Example: Learn How to Value Stocks

Suppose you are attending a busy investor conference and you have come across two interesting pitches. The first one is an AI startup that showcases how they can leverage blockchain-powered neural networks to address many common bottlenecks in the healthcare industry. And the second is a century-old cement company with steady margins and a 5%… Continue reading DCF Valuation Formula & Example: Learn How to Value Stocks

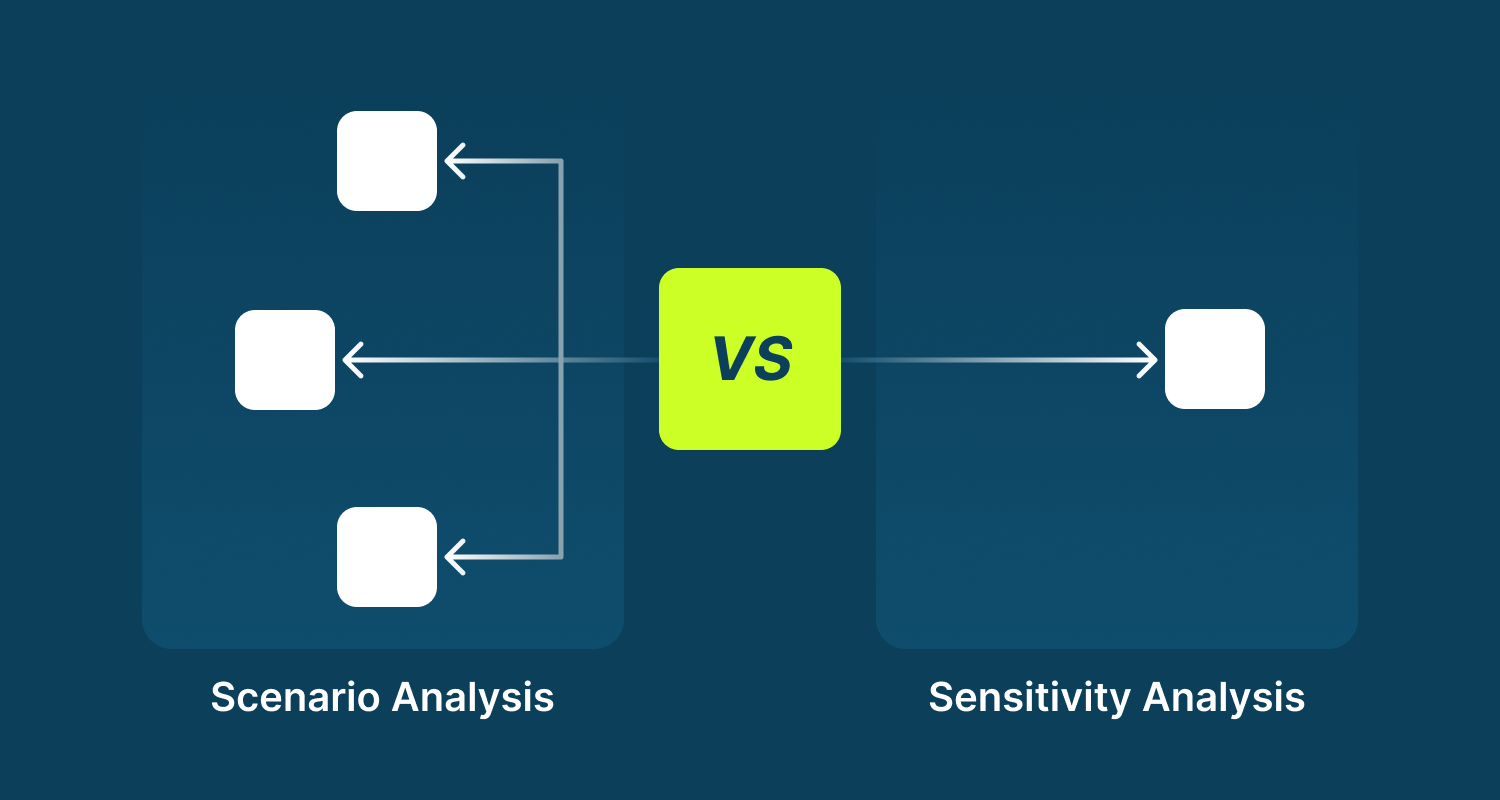

Scenario Analysis vs Sensitivity Analysis: Key Differences Explained

Will your new product become the next big thing, or will supply chain issues sink it? Could shifting consumer trends turn your flagship service obsolete? In these high-stakes moments, two tools rise above the noise: scenario analysis and sensitivity analysis. It’s not about predicting whether it’ll rain tomorrow, it’s about packing an umbrella, sunscreen, and… Continue reading Scenario Analysis vs Sensitivity Analysis: Key Differences Explained

Discounted Cash Flow (DCF) Explained: Your Guide to Smart Investment Decisions

Imagine you’re considering buying a small coffee shop. The owner claims it’s a goldmine, but how do you really know if it’s worth the asking price? Should you trust their gut feeling, or is there a way to quantify its value based on cold, hard numbers? Enter the Discounted Cash Flow (DCF) method, a financial… Continue reading Discounted Cash Flow (DCF) Explained: Your Guide to Smart Investment Decisions