Financial Statements List, Types, and How to Read Them?

All businesses, from small start-up companies to larger multinational corporations, utilise financial statements to determine their financial viability. They play a critical role for internal management processes but also act as important resources for investors, creditors, analysts, and regulators. So knowing the different kinds of financial statements, and learning to read through financial reports can give you valuable… Continue reading Financial Statements List, Types, and How to Read Them?

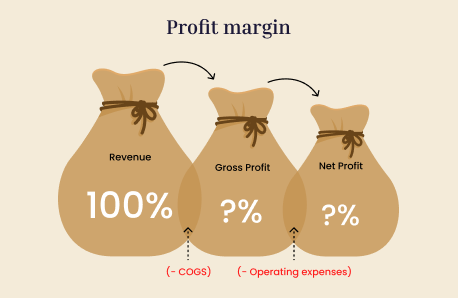

What is Profit Margin And How Do You Calculate it?

The profit margin is one of the most basic concepts any business must understand if it seeks to gauge its financial performance and enhance business profit. Regardless if you are a startup, a scaling enterprise, or doing reading financial statements, learning how to calculate profit margin is essential for making informed decisions, pricing products appropriately, and to… Continue reading What is Profit Margin And How Do You Calculate it?

How to Use a Cash Flow Forecasting Template for Full Financial Control

With a rapidly changing business landscape, knowing your numbers is no longer a luxury, it is an essential. Be it your startup, your flourishing enterprise, or your personal finances, knowing the whereabouts of your money is the key. This is where the cash flow forecasting template comes in very handy. It enables you to forecast your cash flow,… Continue reading How to Use a Cash Flow Forecasting Template for Full Financial Control

Understand Gross Profit Margin to Boost Your Business

In the ever-changing business world, where success is often reduced to cold hard numbers, gross profit margin is one of a handful of real indicators of a company’s health. While this number can be reflective of the profit of a business, it is going to be directly related to its efficiency, pricing strategy, and the overall costs.… Continue reading Understand Gross Profit Margin to Boost Your Business

What Is Discounted Cash Flow (DCF) & How to Calculate It

Discounted Cash Flow (DCF) is one of the most essential valuation methods we have in finance and investing. A business owner who wants to discover the value of your company or an investor who wants to make better investment decisions, knowing discounted cash flow is a must. It is considered to be an accurate way to estimate… Continue reading What Is Discounted Cash Flow (DCF) & How to Calculate It

Discounted Cash Flow (DCF) Formula with Templates

The discounted cash flow (DCF) is one of the most popular valuation methods in finance and investment analysis. It allows you to pull all future cash flows expected to be received from an investment to a single starting point in time (now) to determine its value. This method relies on the principle that a dollar today will earn… Continue reading Discounted Cash Flow (DCF) Formula with Templates

Financial Modeling and Valuation: A Practical Valuation Guide

Financial modeling and business valuation are two of the most important skills for investors, executives, and analysts in the world of corporate finance; Whether you are considering a potential investment in a startup, appraisal of a merger or acquisition, or simply trying to grasp the financial condition of a company, these two elements provide a systematic, numerical… Continue reading Financial Modeling and Valuation: A Practical Valuation Guide

13 Week Cash Flow Model (TWCF): Forecast Like a Pro

In the current economic scenario, with all the uncertainties, cash flow management is one of the most important aspects of running a business. The 13-week cash flow model (TWCF) has become a cornerstone of corporate financial planning in recent years, reflecting the challenge many companies face in balancing liquidity needs against short-term obligations. TWCF template provides you… Continue reading 13 Week Cash Flow Model (TWCF): Forecast Like a Pro

Preparing a Cash Flow Forecast: the Complete Guide

Having a thorough knowledge of your company’s cash position with cash flow management is essential for long-term financial success. Preparing a cash flow forecast is one of the best ways to take charge of your financial situation whether you are a startup founder, an SME owner or a solo entrepreneur. A cash flow forecast shows the… Continue reading Preparing a Cash Flow Forecast: the Complete Guide